Slides

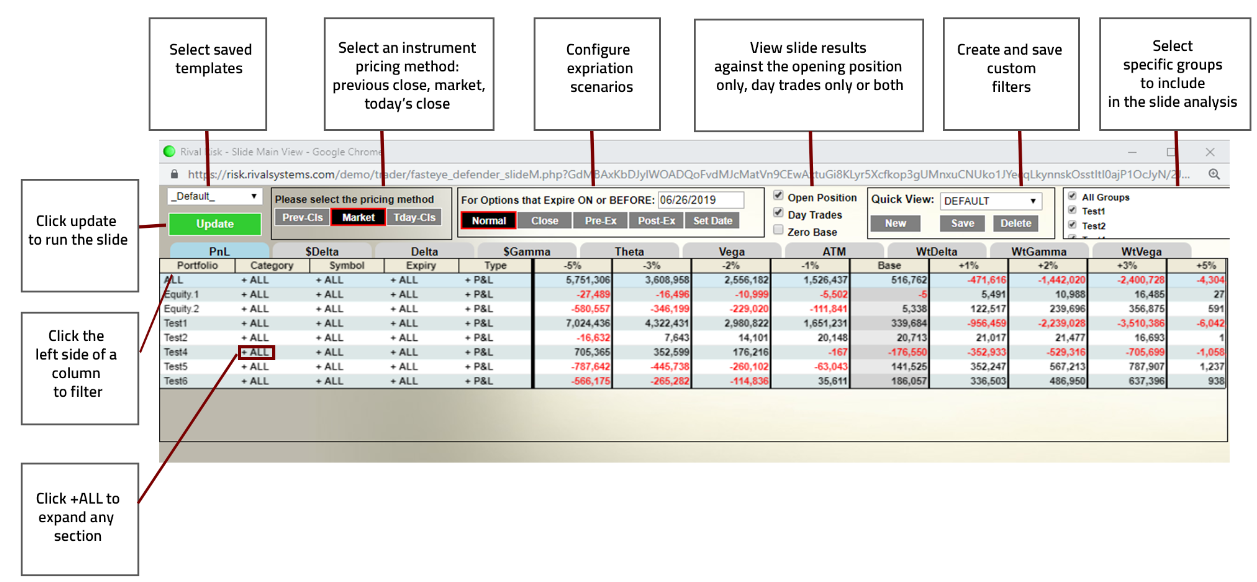

Generate risk slides with user-defined price and volatility scenarios.

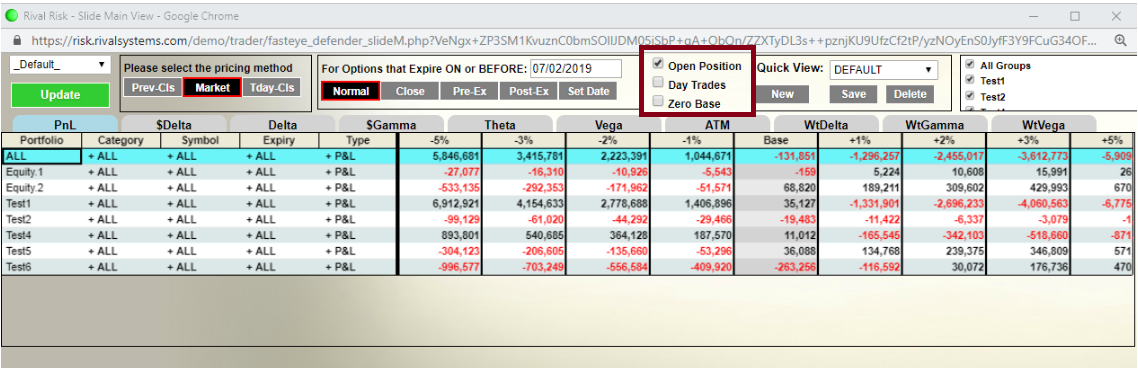

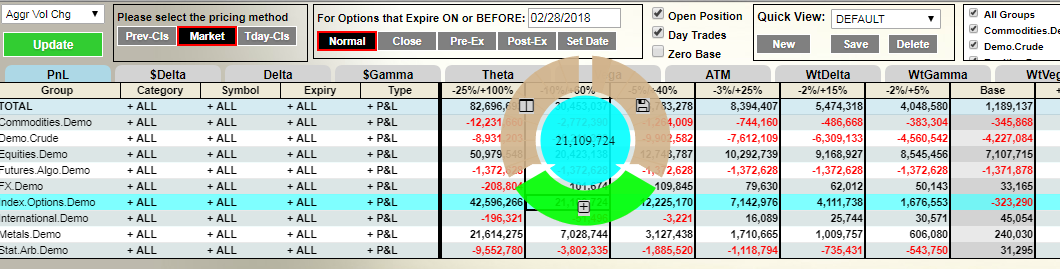

The Risk Slide page can be used to filter out opening position only or day trades only. By default, both the Open Position and Day Trades boxes will be checked.

As an example, to view the risk slide based on the opening position only, check the Open Position box and uncheck the Day Trades box:

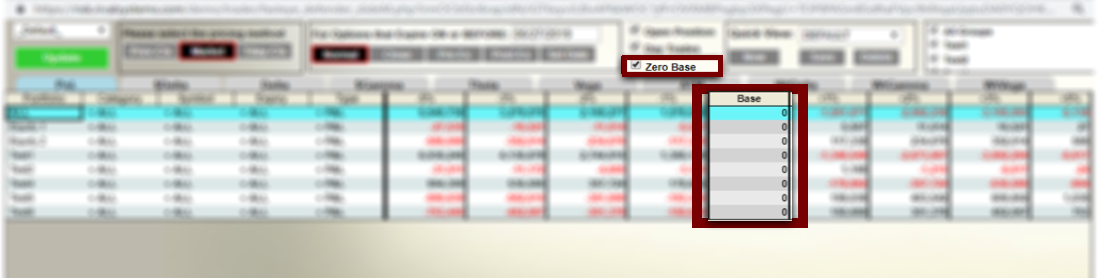

Select Zero Base to set the Base level values to zero. Scenario levels will be reflective of a change from zero:

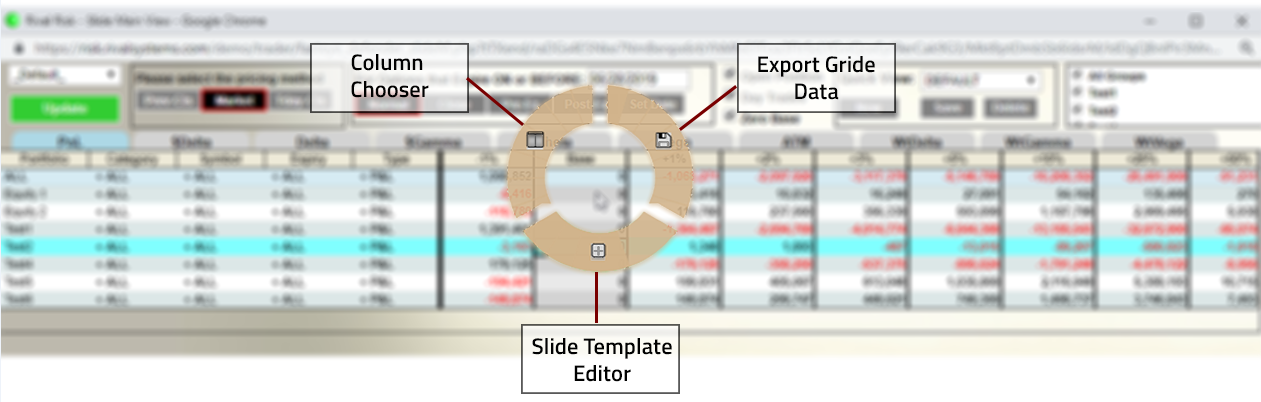

Wheel Menu (Slides)

The Wheel Menu allows you to navigate to additional levels of functionality within the Slide View. Right click within the Slide View page to access the Wheel Menu.

Rival Risk Slide Template Editor

The slide template editor allows you to create and manage custom stress test scenarios by simulating different underlying price and volatility levels.

Create a new slide template

Right click in the slides page and select the + icon from the wheel menu to open the Slide Template Editor window

a. Pop-up blockers could block the window and may have to be disabled

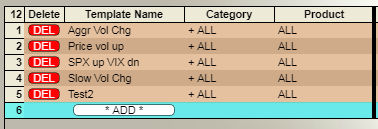

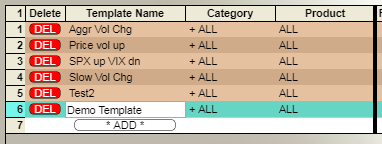

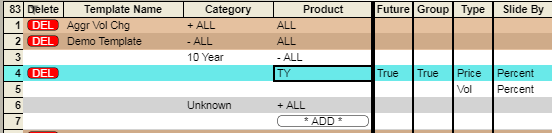

Click the * Add * button in the Template Name column

Type in the name of the new template and hit Enter on your keyboard

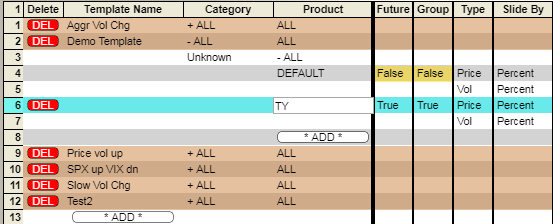

Click +ALL in the Category and Product columns to expand each section

Use the DEFAULT to create a scenario that will be applied to all products

To set slide values for specific product types click the * ADD * button in the Product column and type in a product symbol

a. For a group of products (e.g 10 Year Treasuries) enter the base symbol (e.g TY)

b. For a specific future or equity type in the full symbol (e.g TYH9)

The Category field will automatically populate after the Product symbol is input

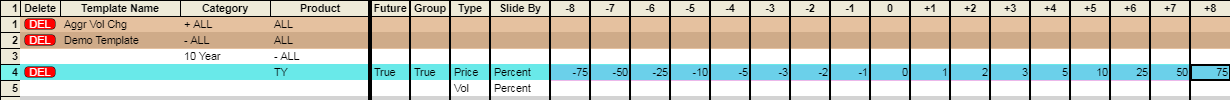

In the Future column select True or False based on the type of product

In the Group column select True if the symbol is to be used for all futures with the same base symbol (e.g TY for all 10 Year Treasuries)

Within the Type column, Price designates an underlying move and Vol designates a volatility move

In the Slide By column choose to apply the Price scenario based on a Price move or Percent move

a. The Vol scenario will only be available as a Percent move

Enter scenarios in any of the 16 (-8 to +8) levels available

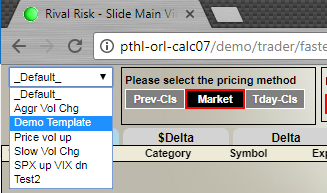

Once the new slide template has been created, refresh the Slides page window to update the dropdown list of templates

Delete Product or Slide Template

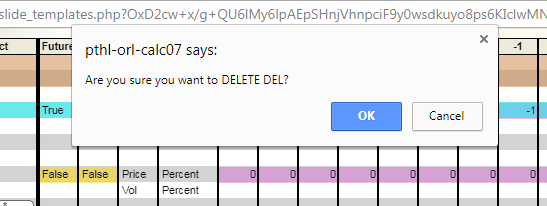

To delete an entire slide or individual product within a slide, click on the delete button in the corresponding row

Click OK or Cancel in the pop-up window

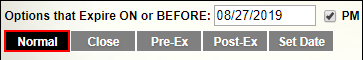

Expiration Scenarios

The Expiration Scenarios section (in the For Options that Expire ON or BEFORE box) include common scenarios for viewing risk on, before or after expiration.

Normal

Uses today's date and current market as Base

Applies user-defined shocks against the existing position at the time the slide is run

Close

User-defined expiration date

Uses current market as Base

Simulates a scenario to close all options expiring on or before the date set

Close at current mid-market and hedge based on current delta (into underlying at mid-market)

Pre-Ex (Pre-Expiration)

User-defined expiration date

Options expiring on or before that date are set to 1 vol

Options are not assumed to be exercised/assigned but are assigned at 100 or 0 delta based on futures price at each scenario level

View options delta and futures delta at each level

All options expiring after date set are handled using the Normal method (see above)

Post-Ex (Post-Expiration)

User-defined expiration date

This scenario assumes the current futures market price is the settle price

Options are assumed to be exercised/assigned based on the current price

Cash settled options will have a 0 delta

Options that settle into futures will have a 100 or 0 delta

Options delta is netted against futures

Price scenarios are run against netted deltas of exercised/assigned options and futures at current price

All options expiring after set date are handled using the Normal method

Set Date

Set a specific date in the future

Days are taken out of all options held

Options expiring on or before the set date are handled using the Post-Ex approach

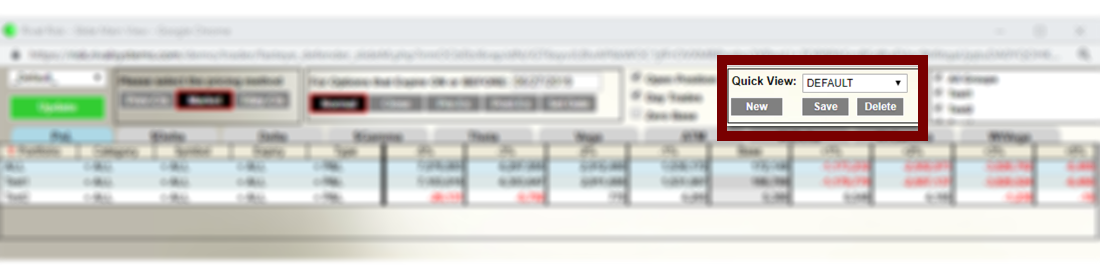

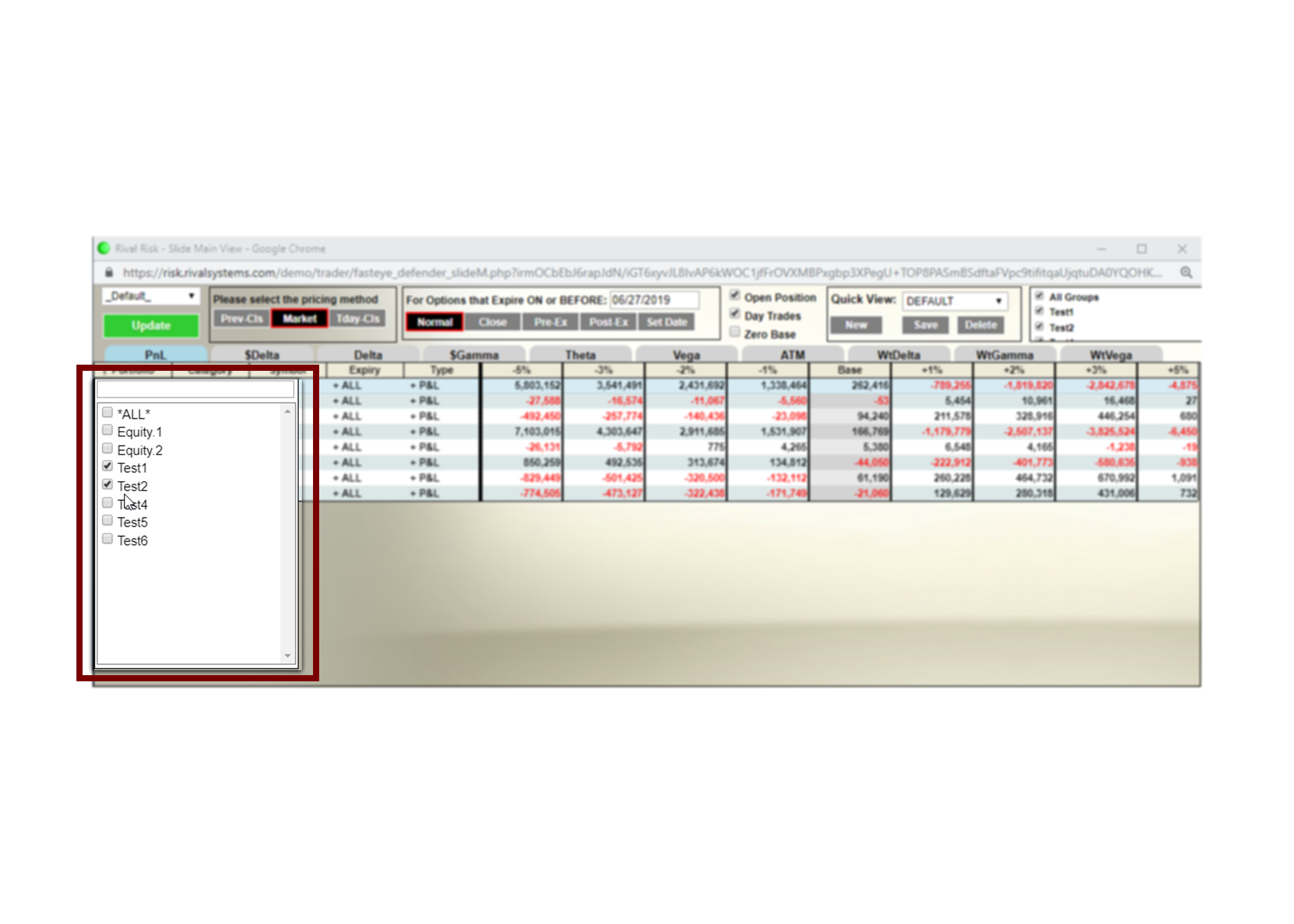

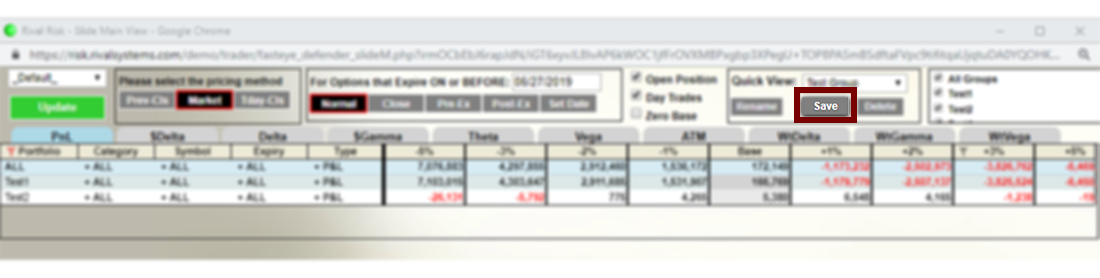

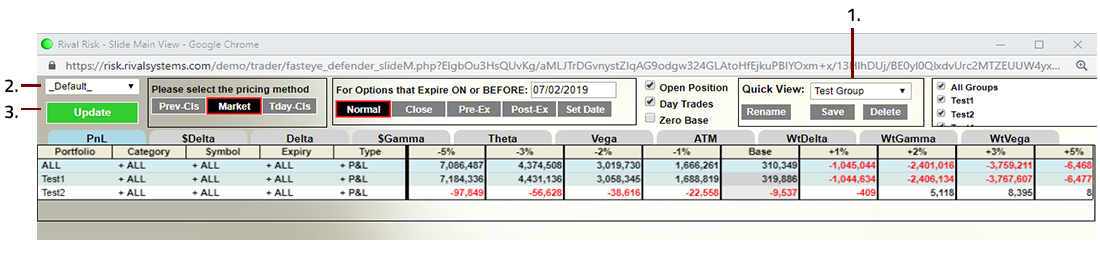

Quick View

The Quick View save functionality works in conjunction with the filtering available in the Portfolio, Category, Symbol, Expiry and Type columns (left side of the slide page). Custom filters can be saved and applied for use with slide scenarios.

To create a Quick View group, use the filter function to select the Portfolio, Category, Symbol, Expiry or Type to be included:

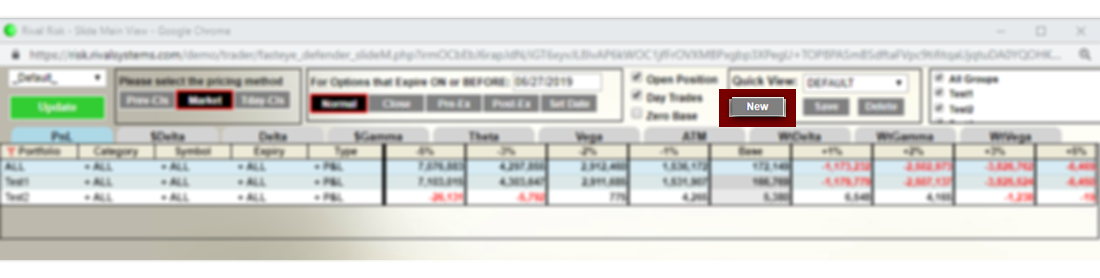

Click the New button:

Enter a name and click Add:

Click Save:

The new custom filter will be available from the Quick View menu:

To apply the Quick View filter:

Select the Quick View group

Select the slide template

Click Update to run the slide